counterpoint 16m us china bradshaw financial times

In the complex dance of global economics, few partnerships are as intricate and consequential as that between the United States and China. As the world’s two largest economies, their financial interdependence is undeniable, yet often fraught with tension and competition. The latest chapter in this economic saga, dubbed Counterpoint 16M, reveals a nuanced narrative of collaboration and rivalry, echoing through the corridors of power and the markets alike.

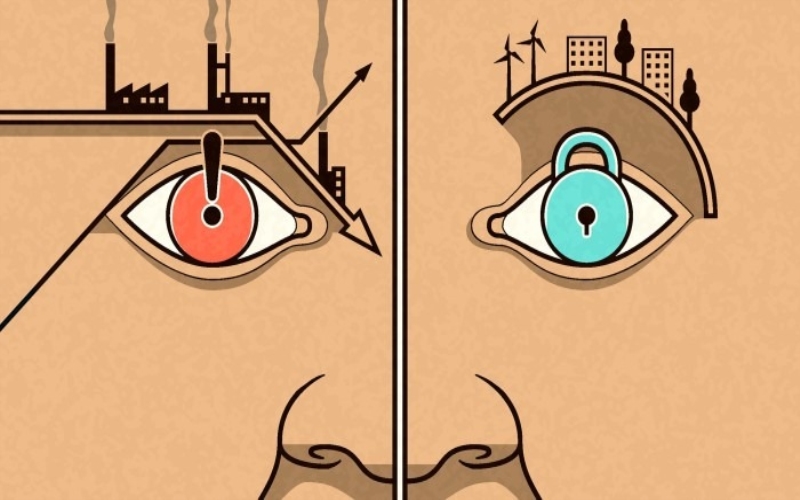

At the heart of Counterpoint 16M lies a strategic confluence of factors, blending economic imperatives with geopolitical maneuvers. On one hand, the United States and China are deeply intertwined in a symbiotic relationship, with trade flows, investment ties, and financial linkages shaping the contours of the global economic landscape. However, this interdependence is juxtaposed against a backdrop of geopolitical friction, characterized by trade disputes, technological rivalries, and strategic maneuvering for dominance.

The financial realm serves as both a battleground and a meeting ground for these competing forces. In recent years, tensions between Washington and Beijing have escalated, punctuated by tit-for-tat tariffs, sanctions, and geopolitical posturing. The Trump administration’s “America First” agenda fueled a wave of protectionism, targeting China’s trade practices and technology sector, while Beijing responded with its own measures to safeguard national interests.

Against this backdrop, Counterpoint 16M emerges as a pivotal juncture, marked by a delicate balancing act between cooperation and confrontation. The financial markets, as ever, serve as a barometer of sentiment, reflecting the ebb and flow of geopolitical tensions. Volatility becomes the new norm, as investors navigate the choppy waters of uncertainty, weighing the risks and rewards of exposure to US-China dynamics.

At the heart of Counterpoint 16M lies a series of interconnected themes, each shaping the contours of the US-China financial relationship:

- Trade Dynamics: The trade war between the US and China, ignited by tariff escalations and retaliatory measures, continues to cast a shadow over global commerce. Despite sporadic truces and negotiations, structural issues persist, from market access to intellectual property rights, underscoring the deep-seated tensions between the two economic giants.

- Investment Flows: Foreign direct investment (FDI) flows between the US and China offer a window into the evolving contours of economic engagement. While Chinese investment in the US has faced increased scrutiny under the Committee on Foreign Investment in the United States (CFIUS), American companies continue to eye the vast potential of the Chinese market, albeit amid regulatory hurdles and geopolitical headwinds.

- Financial Markets: The interconnectedness of financial markets amplifies the ripple effects of US-China dynamics. From currency fluctuations to asset valuations, every move in Washington or Beijing reverberates across global exchanges, underscoring the systemic risks posed by geopolitical brinkmanship.

- Technology Frontier: The technological rivalry between the US and China adds a new dimension to Counterpoint 16M, as both powers vie for dominance in emerging sectors such as artificial intelligence, 5G, and quantum computing. The contest for technological supremacy extends beyond economic considerations, encompassing national security imperatives and ideological clashes.

- Geopolitical Chessboard: Beyond the realm of economics, Counterpoint 16M reflects the broader geopolitical chessboard, where the US and China jostle for influence across regions and domains. From the South China Sea to cyberspace, from Belt and Road initiatives to alliances and partnerships, the contest for geopolitical primacy shapes the contours of US-China relations in the 21st century.

As Counterpoint 16M unfolds, stakeholders grapple with a kaleidoscope of challenges and opportunities, navigating the shifting currents of geopolitics and economics. While cooperation remains essential on issues of mutual interest, from climate change to pandemic response, the specter of rivalry looms large, casting a shadow of uncertainty over the future trajectory of US-China relations.

In this complex landscape, policymakers, businesses, and investors alike must embrace a nuanced understanding of Counterpoint 16M, recognizing the interplay of economic, geopolitical, and technological forces shaping the destiny of nations. As the world watches with bated breath, the US-China financial tango continues, with each step forward revealing new possibilities and pitfalls on the path to a shared future.